|

||||

|

Current Parity Price Schedule

Commodity Parity Prices and Price as Percent of Parity Price - United States: December 2025

with Comparisons

[Parity prices are computed under the provisions of Title III, Subtitle a, Section 301 (a) of the

Agricultural Adjustment Act of 1938 as amended by the Agricultural Acts of 1948, 1949, and 1956.

See February "Agricultural Prices" for details on adjusted base price and parity price

computations. Parity data not available for blank cells. Primary source of data for livestock and

milk prices is United States Department of Agriculture's Agricultural Marketing Service]

----------------------------------------------------------------------------------------------------

: : Parity price : Price as percent

:Adjusted : : : of parity

Commodity and unit : base :-----------------------------------------------------------

: price :December :November :December :December :November :December

: : 2024 : 2025 : 2025 : 2024 : 2025 : 2025

----------------------------------------------------------------------------------------------------

: ------------- dollars ------------- ------- percent ------

:

Basic commodities :

All wheat ............bushel: 0.522 20.40 21.60 21.60 27 23 23

Rice ....................cwt: 1.29 49.60 53.40 53.60 30 24 26

Corn .................bushel: 0.392 15.10 16.20 16.20 28 25 25

Cotton :

Upland ..............pound: 0.064 2.48 2.65 2.66 25 23 22

American Pima .......pound: 0.137 5.23 5.34 5.36 28 26 26

Peanuts ...............pound: 0.020 0.763 0.828 0.831 32 28 27

All milk, to plants .....cwt: 1.71 66.80 70.80 71.10 34 27 26

Barley ...............bushel: 0.491 18.60 20.30 20.40 35 28 25

Dry edible beans ........cwt: 3.05 116.00 126.00 126.00 33 29 26

Flaxseed .............bushel: 1.13 43.90 46.80 47.00 28 27 26

Oats .................bushel: 0.292 11.30 12.10 12.10 28 26 27

Sorghum grain ...........cwt: 0.703 26.90 29.10 29.20 27 21 21

Soybeans .............bushel: 0.967 37.80 40.00 40.20 26 26 26

Beef cattle .............cwt: 12.10 458.00 501.00 503.00 41 45 44

Eggs ..................dozen: 0.124 4.35 5.13 5.15 89 38 29

Hogs ....................cwt: 5.13 203.00 212.00 213.00 31 31 29

Parity ratio .................: 34 31 30 (1910-14 = 100)

to date calendar year average (2025) = 34.1

[Above extracts are from "agpr0126.txt" published 01/30/26, retrieved on 31 Jan. 2026 from:

https://esmis.nal.usda.gov/sites/default/release-files/795747/agpr0126.txt]

Frederick Soddy: extract from Wealth, Virtual Wealth and Debt, 2d Ed. 1933

Prosperity Unlimited The American Way: 75th anniversary digital edition

"Did we earn it?" Two page article by Randy Cook

{PDF} 400kb May 2022

Sample resolution discussing issuance of lawful, local, U.S. money

{PDF} 53kb Apr. 2022

Republished: Raw Materials National Council 1941 pamphlet "Prosperity Is Within Our Grasp"

{PDF} 30Mb 16 Jan. 2019

U.S. House Ag Committee Testimony, 30 August 2017 (three pages)

{PDF}

"How and why" of Equitable Trade, 2017 (one page)

{PDF}

An Economic "backdoor" proposal & USDA ag Parity Ratio table (1945-2016), 2017

{PDF}

Larger questions and what's missing in Bowman v. Monsanto

{PDF}

An Option for Economic Recovery, 2013

{PDF}

No New “Farm Bill” is Better, here’s why.

{PDF}

Animal Disease Traceability (ADT), a.k.a. National Animal Identification System (NAIS), Rebutted

Letter to Senators Stabenow & Levin on S.510

Federal Register Comment submitted to FDA

Greg Niewendorp Response to Michigan

Dept. of Agriculture

National Economic Stability Act {PDF} MP3 Audio recording by Randy Cook: Sixty Percent (download 2MB, right click link and save target to your directory) AN ADAPTIVE PROGRAM FOR AGRICULTURE (PDF - 61 page document) Borrowing Our Way Out Of Debt? "Dirty Little Secret" A Brief History of the One-World Government Movement {PDF} The Elusive Agrarian Economic “Hole in One” {PDF} |

|||

| BACK TO TOP

OF PAGE! |

Animal Disease Traceability (ADT), a.k.a. NAIS, Rebutted Common law "Notice and Demand" was served on elected officials in Wisconsin on 7 February 2012. This filing addresses regulatory authority over

agriculture claimed by the federal government as administered by federal and state agencies. The writ was composed and served by Paul Griepentrog, Vice-President

of NORM. It was served on the Wisconsin legislature's Joint Committee for Review of Administrative Rules, the State's House Committee on Agriculture, the State's

Senate Committee on Agriculture, Forestry, and Higher Education as well as the Governor, Attorney General, Wisconsin's two U.S. Senators and Griepentrog's

representative in Congress.

The Notice and Demand responds to actions of Wisconsin's Department of Agriculture, Trade and Consumer Protection (DATCP) and that agency's

attempts to implement USDA's National Animal Identification System (NAIS), now known as the Animal Disease Traceability (ADT) program. Every item in this writ

speaks to the overreaching of government concerning authority to regulate the basic elements of our daily lives, particularly agriculture which provides

our "daily bread."

Why is it important to resist these governmental efforts? Because government is prohibited from restricting our freedom of association, our

liberty to provide for our families and communities as we see most fitting. This prohibition reserves to the people the basic tools required to build a

sound and secure social structure, a civilization that elevates and expands human dignity, value and opportunity. If we allow ourselves to be forced to

comply with policies whose aim is to cheapen our labor under the false belief that trade is the only goal of our productive efforts, we will have lent our

support to the prevailing atmosphere of dissipation, depression, decline and loss of liberty.

Supreme Court Justice Kennedy, in an opinion issued 16 June 2011, wrote:

Clearly the Supreme Court continues to recognize that individuals who suffer injury when government commits acts beyond their Constitutional

authority or jurisdiction have standing to assert their right of redress. Indeed it may be the only remaining way to keep government "in the box" of

Constitutional limits, given the degree of corruption in our political process at every level.

"Notice" is taken of items conflicting with reasonable or lawful actions. State statutory citations are particular to Wisconsin. Your

State's governmental agreements, statutes and records will likely be different but when you search for them, you will discover similar actions.

Essentially, the ADT program is administered by State agencies on behalf of the federal government under performance contracts whereby

State agencies receive federal funding for program enforcement. These contracts must be cooperative, not exclusive, and, by that requirement, are not

intended to substitute for, displace or override State statutory enactments. Nor can they in any way change State or federal constitutional guarantees

or requirements.

Another important principle asserted is that rules and regulations written by administrative agencies like USDA or FDA, cannot limit,

expand or modify the intent of the legislation delegating authority to that agency for accomplishing its statutorily assigned task. Administrative rules and

regulations must be "reasonably well adapted" to accomplish the goal or intent of that legislation and may not violate constitutional guarantees of

substantive rights or due process.

Federal statute providing for proper administrative procedure states: "Except as otherwise provided by statute the proponent of a rule or

order has the burden of proof." Be aware that "due process" does not occur within any administrative hearing. Such hearings are for establishing facts,

claims, evidence and rulings. Only after a "final determination" has been issued by an agency's administrative process can redress be pursued within "due

process" in State or federal court.

It is clear that tagging livestock does not promote or effect disease prevention and can reasonably be presumed to implement an international

scheme supporting private interest's world trade preferences. Governmental tracking of "chattel property" has recently been ruled by the Supreme Court to

violate the prohibition against "unreasonable searches and seizures." US v. Jones No. 10-1259 (2012).

The document also notices the failure of USDA to implement the policy of Congress to justly compensate farmers for their loss of individual

marketing rights. Those rights were taken in the "national public interest" in 1933 under a declaration of national emergency which has never been terminated.

Congress authorized the Secretary of Agriculture to "regulate the markets" so that farmers received parity prices as just compensation. The latest year of

100% agricultural parity was 1952. Income loss to the nation's farmers from 1953 through 2010 amounts to $8.135 trillion. The same period's loss of income

to Wisconsin farmers is around $247.3 billion. These losses give cause to raise a "takings claim" under the Fifth Amendment.

It is also noticed that those people who administer any rules that have been rebutted in the document have knowingly participated in violating

the substantive rights of those individuals toward whom they have acted. Two questions clearly make this point: 1) Is it lawful to assist in the commission

of a "crime?", and 2) Is it lawful for me to assist you in the commission of your "crime?"

Under the "Demand" portion of the document, it is asked that all individuals (natural persons) unlawfully prosecuted or forced into compliance,

be made whole. Appropriate committees of the State's legislature are directed to convene hearings concerning the wrongful acts of the State's DATCP agents.

The State's Attorney General is directed to prosecute suits regarding the lost income of both Wisconsin's farmers and the State. As an alternative to the

"lost income" suits, demand is made for prosecuting a suit invalidating the current USDA scheme of regulation on grounds of being ill-adapted to achieve

Congressional policy as evidenced over the last 58 years.

Wisconsin's response to this "Notice and Demand" may be silence. In that case, the specific assertions in the document will be considered

"admitted," and thus legally established.

We have only those rights we can defend. Paul Griepentrog's "Notice and Demand" is a long needed beginning in that defense.

Randy Cook 2/13/12

Notice and Demand, PDF of complete filing (33 pages)

|

|||

| BACK TO TOP

OF PAGE! |

Letter to Senators Stabenow & Levin on S.510 With a late "lame duck" session of Congress, the Senate is set to consider S.510, the

"FDA Food Safety Modernization Act." Senate Rule XXII on "cloture" or limiting debate and avoiding a filibuster

has been invoked. In our opinion, and that of many others, this is damaging legislation.

I felt it necessary to inform my Senators of the arguments NORM submitted to the FDA regarding their

erroneous "presumption of jurisdiction" (see the "Federal Register Comment" item below). Here is the text of that letter.

Nov. 8, 2010

Honorable Senators Stabenow and Levin:

The interest of this message concerns S.510, "FDA Food Safety Modernization Act." Mr. Levin, I note your affirmative vote for cloture although I am ignorant of your reasons for limiting debate. Perhaps your vote was to simply expedite disposition of this bill. If so, my prayer is that each of you meet your obligation to fully investigate, on the record, the intention of this legislation and its potential impact on the primary producers of the wealth of this nation.

It appears that the intent of this bill is to require a federal license to produce, harvest, process, sort, pack, manufacture, hold or store anything the Secretary of Health and Human Services (a.k.a. the President of the United States) determines to be "food." It also appears that the regulatory scope of this bill vastly exceeds the power delegated to the federal government by the Constitution.

Please note: as stated in Art. I, § 8, cl. 18, "Congress shall have power to make all laws which shall be necessary and proper for carrying into execution the foregoing powers, and all other powers vested by this Constitution in the government of the United States, or in any department or officer thereof." Regulatory jurisdiction, statutorily delegated to any agency, cannot exceed the jurisdiction of the legislative authority as constitutionally specified.

Regulatory powers or authorities are exercised according to the rules or orders issued by federal agencies according to jurisdiction delegated to that agency through authorizing legislation. 5 U.S.C. § 558(b), "A sanction may not be imposed or a substantive rule or order issued except within jurisdiction delegated to the agency and as authorized by law."

The Federal Food, Drug and Cosmetic Act (FFDCA) provides administrative authority for prohibiting "[t]he introduction or delivery for introduction into interstate commerce of any food, drug, device, or cosmetic that is adulterated or misbranded." 21 U.S.C. § 331(a).

The Public Health Services Act (PHSA) provides administrative authority to "prevent the introduction, transmission, or spread of communicable diseases from foreign countries into the States or possessions, or from one State or possession into any other State or possession." 42 U.S.C. § 264(a).

Both of these statutes (FFDCA and PHSA) delegated authority specifying the scope of regulatory action as concerning the relations between and among the States, not within any State unless a federal enclave exists such as a "port of entry" over which federal jurisdiction would fall (Art. I, § 8, cl. 17). For example, 21 C.F.R., § 1.83, provides as follows: "The term 'district director' means the director of the district of the Food and Drug Administration having jurisdiction over the port of entry through which an article is imported or offered for import." [Emphasis added.]

From 1976 until 1997 the FFDCA jurisdictional presumption of a connection with interstate commerce (21 U.S.C. § 379a) applied to "a device," not "a device, food, drug, or cosmetic." The 1997 amending language could not have expanded the fundamental delegated legislative jurisdictional authority. It could only have expanded the items to which such regulations may apply, not the situs for regulatory application. The jurisdictional presumption of § 379a is thus rebutted and the burden rests upon the regulating agency to prove intent to engage in interstate commerce in order to apply any regulatory sanction within a State.

The PHSA statement authorizing "necessary" agency created rules and regulations for protection against "communicable diseases" moving "from one state...into any other state" explicitly recognizes the existence of governing bodies called "States." It also implies geographical areas within which those States have their own authority and sphere of action. Otherwise there would be no "from one...into another" relationship.

If it be claimed by a federal entity that constitutionally harmonious acts taken pursuant to the federally delegated power to regulate commerce among the States can, with impunity, operate within rather than among those States, then by that claim those States are made internally incompetent and obsolete on that point of authority, negating their existence by usurpation to the federal regime, contrary to the 10th Amendment guarantee.

This would shred the historical construction of the federal level, negating the initial competency required for establishing federal power. The created would become greater than its creator, an impossibility according to God's lessons. Either the States are competent agents of their own populations with their own original and exclusive jurisdictions while the federal level may regulate (make regular) the commercial relations among them or the States are superfluous and redundant hurdles to federal hegemony. Asserting a "middle ground" on this point would only illuminate the wellspring of the truths written into our Declaration of Independence, the genesis of our own revolution.

We, human beings, each have inalienable rights to work and travel. Corporate entities, being creatures of law and government, have only those rights granted by law and government. If you take the time to survey the facts of every food recall that has been issued, you will find a corporate entity in the supply chain. Regulation of natural persons is beyond federal reach unless those natural persons are employed by or serve within a federal enclave. No rational argument can justify an alternate conclusion.

This bill does not encourage our own domestic producers to positively respond to the flood of imported consumptive goods through proper payment to ourselves for that necessary domestic production. It seeks to place our primary producers into an unworkable, unsafe scheme designed to reduce liberty and increase regimentation under a federal regime without basic constitutional authority. The original source of national wealth is in our labor, as applied to our God-given complement of natural resources. Our current dire economic condition is the result of six decades of underpayment to those primary laborers for the production which they have already provided. As pointed out by former Federal Reserve Board Chairman Marriner S. Eccles, "Labor, after all, is our only source of wealth." [Testimony before the Senate Finance Committee, Feb. 24, 1933.]

Mathematics is the mother of safety. Decentralized, widely distributed independent producers are an inherently safer source of food than centralized producers, processors and distributors. Concentrated production, processing and distribution, with an increasing dependence on imports (the least safe alternative) are the natural outworking of bad agricultural policies over the last 60 years. That there is a workable alternative, proven so by our own economic record, makes our current situation excruciatingly intolerable. Persistence in this sort of bad legislation will hasten the demise of our nation, something neither I nor you wish to experience any further.

"Familiarize yourselves with the chains of bondage, and you are preparing your own limbs to wear them. Accustomed to trample on the rights of those around you, you have lost the genius of your own independence, and become the fit subjects of the first cunning tyrant who rises. And let me tell you, all these things are prepared for you with the logic of history..."

[Abraham Lincoln, speech at Edwardsville, Illinois, Sept. 11, 1858.]

Sincerely,

Randy Cook

President, National Organization for Raw Materials (NORM)

This letter was the topic of discussion on the Dr. Rima Reports radio show Nov. 14, 2010. Randy Cook was her guest.

|

|||

| BACK TO TOP

OF PAGE! |

Federal Register Comment submitted to FDA The federal Food and Drug Administration opened Docket No. FDA-2010-N-0085 in the

Federal Register on March 12, 2010. They invited comments from "interested parties" so they could write a "proposed rule"

regarding fresh produce food safety. The "proposed rule" will then be posted in the Federal Register, more

comments will be invited and FDA will write a "final rule," again published in the Federal Register.

FDA claims to have legal jurisdiction over individual farms and packing houses so that they can

impose sanctions for non-compliance with their regulation once it is written and published.

This would implement a "food police" system under control of the federal government without

the necessity for Congress to pass any "food safety" bill such as H.R. 2749 or S. 510. Our comment, placed

in the Federal Register, provides a legal argument rebutting the claim of federal jurisdiction over farms owned by natural persons.

June 7, 2010

Submitted by: National Organization for Raw Materials (NORM, www.normeconomics.org)

This comment seeks to inform the development of an FDA regulation establishing “safety standards for fresh produce at the farm and packing house” and sanctions for non-compliance. In doing so, it rebuts the jurisdictional presumption through which, under the guise of “food safety,” FDA seeks to vastly exceed the reach of its federal regulatory sphere of action.

Federal executive regulatory power is seated in and restricted to the delegations specified within the Constitution. As stated in Art. I, § 8, cl. 18, “Congress shall have power to make all laws which shall be necessary and proper for carrying into execution the foregoing powers, and all other powers vested by this Constitution in the government of the United States, or in any department or officer thereof.” Regulatory jurisdiction statutorily delegated to any agency cannot exceed the jurisdiction of the legislative authority as constitutionally specified.

Regulatory powers or authorities are exercised according to the rules or orders issued by federal agencies according to jurisdiction delegated to that agency through authorizing legislation. 5 U.S.C. § 558(b), “A sanction may not be imposed or a substantive rule or order issued except within jurisdiction delegated to the agency and as authorized by law.”

The Federal Food, Drug and Cosmetic Act (FFDCA) provides administrative authority for prohibiting “[t]he introduction or delivery for introduction into interstate commerce of any food, drug, device, or cosmetic that is adulterated or misbranded.” 21 U.S.C. § 331(a).

The Public Health Services Act (PHSA) provides administrative authority to “prevent the introduction, transmission, or spread of communicable diseases from foreign countries into the States or possessions, or from one State or possession into any other State or possession.” 42 U.S.C. § 264(a).

Both of the above statutes, FFDCA and PHSA, delegated authority specifying the proper scope of regulatory action as concerning the relations between and among the States, not within any State unless a federal enclave exists such as a “port of entry” over which federal jurisdiction would fall (Art. I, § 8, cl. 17). For example, 21 C.F.R., § 1.83, provides as follows: “The term ‘district director’ means the director of the district of the Food and Drug Administration having jurisdiction over the port of entry through which an article is imported or offered for import.”

From 1976 until 1997 the FFDCA jurisdictional presumption of a connection with interstate commerce (21 U.S.C. § 379a) applied to “a device,” not “a device, food, drug, or cosmetic.” The 1997 amending language could not have expanded the fundamental delegated legislative jurisdictional authority. It could only have expanded the items to which such regulations may apply, not the situs for regulatory application. The jurisdictional presumption of § 379a is thus rebutted and the burden rests upon the regulating agency to prove intent to engage in interstate commerce in order to apply any regulatory sanction within a State.

The PHSA statement authorizing “necessary” agency created rules and regulations for protection against “communicable diseases” moving “from one state...into any other state” explicitly recognizes the existence of governing bodies called “States.” It also implies geographical areas within which those States have their own authority and sphere of action. Otherwise there would be no “from one...into another” relationship.

If it be claimed by a federal entity that constitutionally harmonious acts taken pursuant to the federally delegated power to regulate commerce among the States can, with impunity, operate within rather than among those States, then by that claim those States are made internally incompetent and obsolete on that point of authority, negating their existence by usurpation to the federal regime, contrary to the 10th Amendment guarantee.

This would shred the historical construction of the federal level, again negating the initial competency required for establishing federal power. The created would become greater than its creator, an impossibility according to God’s lessons. Either the States are competent agents of their own populations, each with their own original and exclusive jurisdiction, while the federal level may needfully regulate the commercial relations among them, or the States are superfluous and redundant hurdles to federal hegemony. Asserting a “middle ground” on this point would only illuminate the wellspring of the truths written into our Declaration of Independence, the genesis of our own revolution.

Conclusion:

FDA is not and, by the construction of this government, cannot be authorized to determine its own jurisdiction. It must operate within the bounds of the administrative structure authorized by the legislative power harmonious with the limited, delegated powers identified in our constitutional system. Belief and possibility may rationalize the desire of the usurper to "do good," but knowledge of and healthy regard for the principles of our self-government must eventually increase our respect for mutual human dignity and illuminate the goals of our endeavor in liberty.

|

|||

| BACK TO TOP

OF PAGE! |

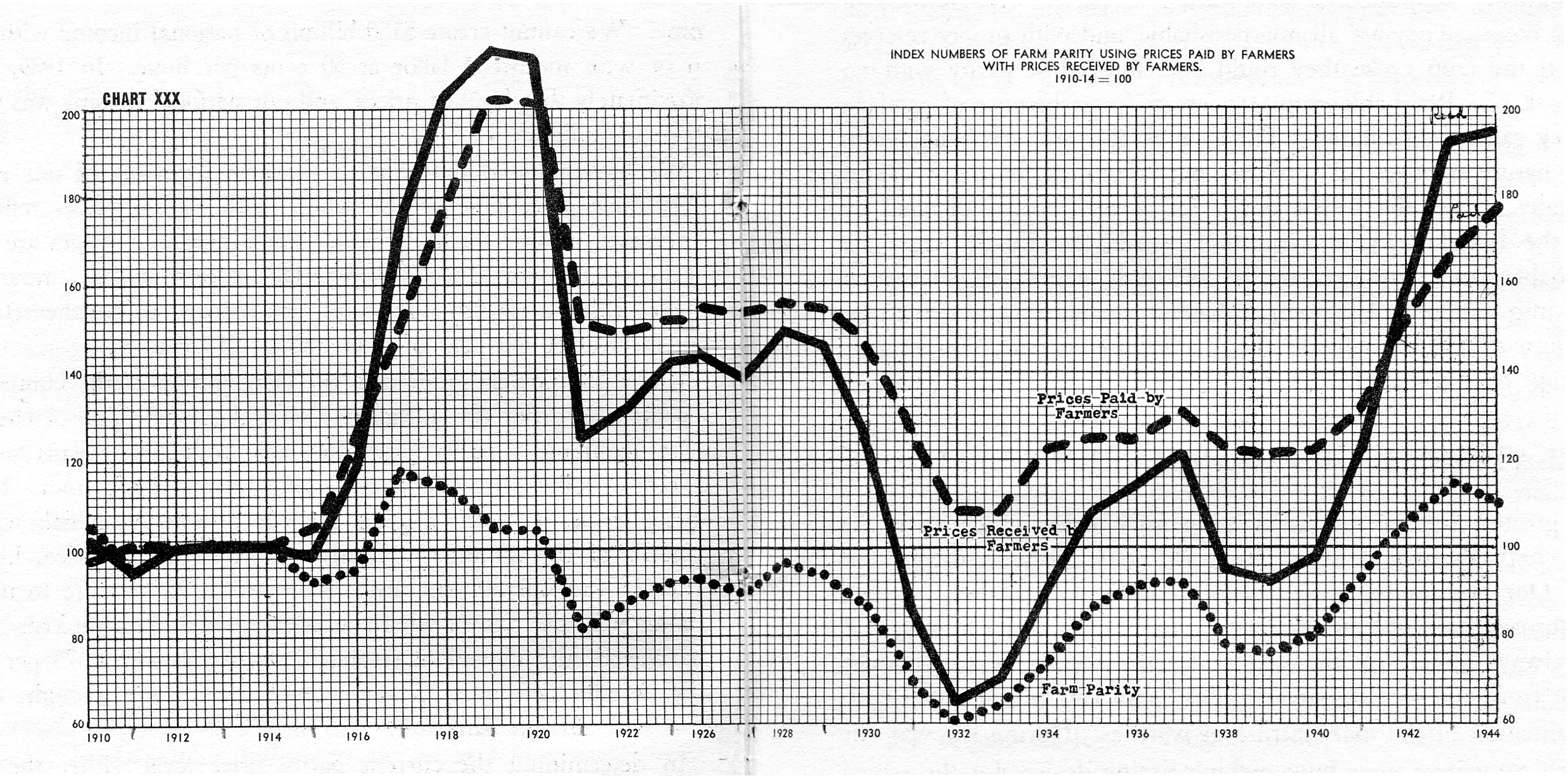

Agricultural Parity Charts Historical records of the performance of our economy have been the focus of NORM's investigations ever since Carl H. Wilken began this study in the 1930s. We now have 100 years of information concerning farm parity and how the "ups" and "downs" of our nation's agricultural profitability have affected our overall economic health. The first chart below was published in Carl Wilken's 1947 book Prosperity Unlimited (pp. 92-93).  This chart covers the time period from 1910 through 1944. The solid line shows the changes in the "Index

of Prices Received," the dashed line indicates changes in the "Index of Prices Paid" and the dotted line

shows the ratio of those two indices (Prices Received divided by Prices Paid). The dotted line charts the

Parity Ratio, as it is called. All indices are referenced to the 1910 to 1914 period of price relationships

as being 100. This simply gives us a straightforward way to compare the price relationships across time.

Fortunately for us, USDA has a legal requirement to continue to calculate these indices using the

same reference period (1910 - 1914 = 100). The "Prices Paid" index (PPITW) and the "Parity Ratio" are

published every month in Agricultural Prices Monthly available through the National Agricultural

Statistics Service (NASS).

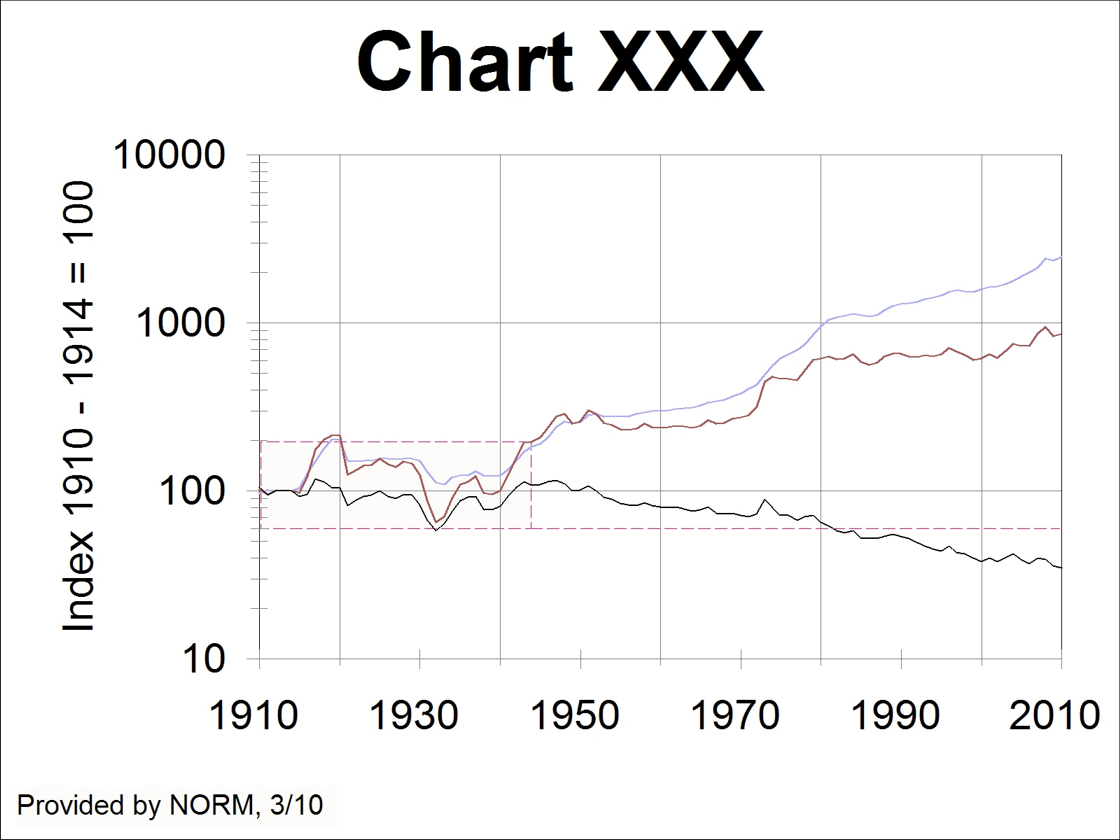

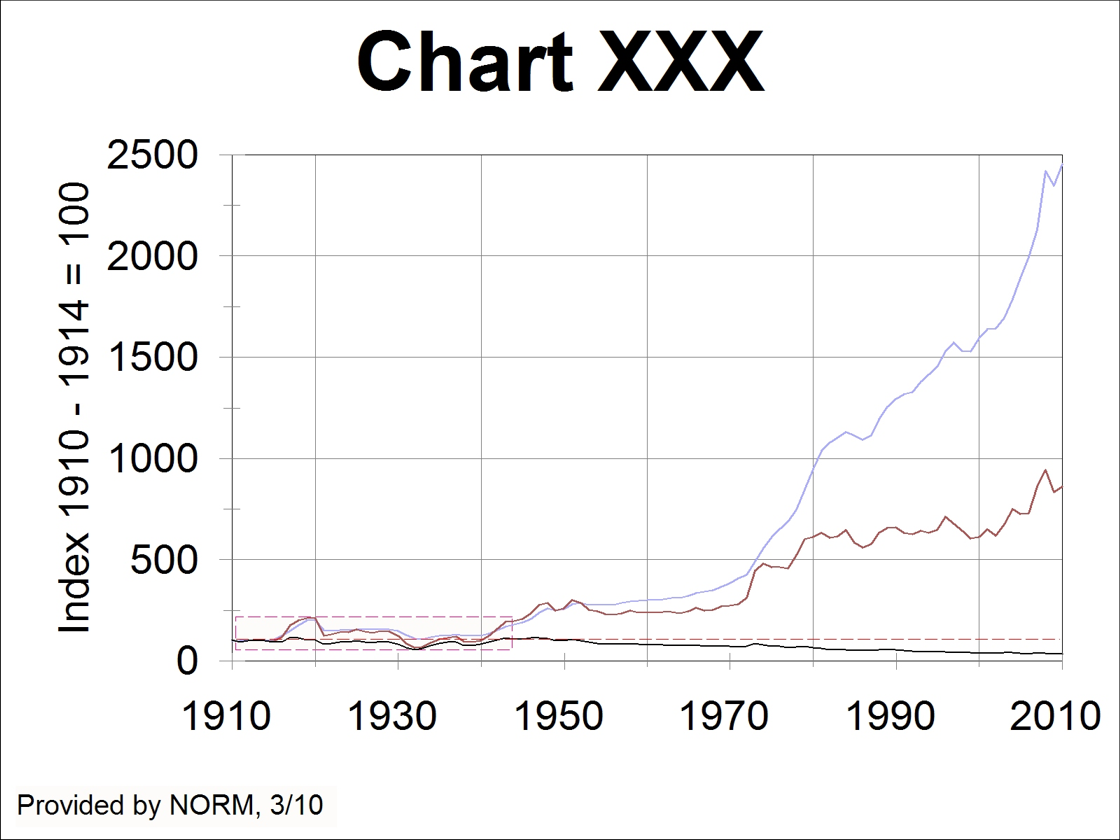

We have compiled the records to continue "Chart XXX," displaying 100 years (1910 - 2009) of actual performance.

In this chart the dark red line is the same as the solid line in the first chart, "Index of Prices Received." The

blue line is the same as the dashed line in the first chart, "Index of Prices Paid." The black line is the same as the

dotted line in the first chart, the "Parity Ratio." The box created by the red-dashed line indicates the same

data displayed in the first chart. The red dashed line stretching out to the right shows the lowest point of parity

during the Great Depression (1932) and the fact that agricultural parity fell below that point in 1982 and hasn't yet

recovered. In fact ag parity is still declining.

The interesting feature of this chart is the Y-axis scale. These data lines are drawn using a logarithmic scale.

This helps to display the detail of the original chart and yet shows the trends of the indices and ratio since the end

of that chart (1944). To get a truer impression of the scale of damage to our nation's agricultural production sector and

the necessary impact on the national economic condition, we will chart the same data using the same (arithmetic) scale of the

original Wilken chart.

In this chart the red-dashed line box covers the data of the original chart and the red-dashed line indicates the 100% parity

axis. Particularly over the last 38 years, our economy has become so out of control, loopy on debt, that prices paid by farmers have increased by a factor of 24.6

while prices received by farmers have only increased by a factor of 8.6, giving us (8.6 ÷ 24.6) the current parity ratio of 35%.

Real earned income, the result of units of new wealth produced, multiplied by the price at which each unit is sold, puts the

floor under the nation's economy, from manufacturing to retailing to services to luxuries. Without earned income no debt can

ever be paid. By cheating our agricultural producers, our mineral, metal, fuel and recycling producers, of the proper earnings to

which they are entitled, we can look ahead to losing our form of government (democratic republic) and our liberties. OR, we can

make a change in our policies and begin paying properly for what we need and use and can produce for ourselves.

|

|||

| BACK TO TOP

OF PAGE! |

Anyone who eats beef or drinks milk, should be very interested in the Greg Niewendorp letter. It was sent to the Director, Michigan Department of Agriculture concerning the attempt of MDA to quarantine his cattle herd. Share this with everyone you think needs to know about it. If you have suggestions for further activity in this matter, send your suggestions along to Greg or Randy. (See the Officers page for contact info.)

BORROWING OUR WAY OUT OF DEBT? Introduction: If debt were the way to prosperity, we would be in paradise. However, this debt policy will lead us only to a fool’s paradise. Why does a country with such an abundance of raw materials, technological skill and private enterprise know-how need to go further into debt? The implementation of the Agricultural Adjustment Act of 1938 and later the Steagall Amendment generated prosperity during times of war and peace from 1941 to 1952. The National Economic Stability Act (NESA) proposed in this report is an improvement over the previous acts. NESA is a self-supporting program, thus reducing the cost of government. NESA will increase the earned income of individuals and broaden the tax base of federal, state and local governments. This program will ensure the United States does not become a country of individuals without assets or freedom — that our free enterprise system is preserved. Prosperity through earned income or false prosperity by increased debt? It's your (and our) choice. Primary Supply: A Basic Perspective The Consumer: The Economy in Microcosm This is precisely where the American economy is falling the shortest. Take a close look at the consumer's condition, and you see that times are every bit as tough as people claim. 1950-1980: The Thirty-Year Slide into Debt In 1950, per capita income was $1,560 per year. Of this amount, the typical consumer paid out 18.5% for food—low by the standards of most of the developed world—and 21.5% for taxes. By 1980, the per capita income had grown to $9,502. Some of this growth was due to real increases in income, but much of it came from inflation, as the dollar lost purchasing power each year. The consumer now put out only 12.3% of income for food and 27% for taxes. In relative terms, then, the consumer's lot had apparently improved. Except on one very crucial count. Back in 1950, the typical consumer was paying out 3.74% of his or her income for interest. In 1980, interest payments actually accounted for 33.9% of the consumer's income. Think for a moment what this means? More than one third of per capita consumer income went to pay interest on indebtedness. How had this debt arisen? And what does it mean for all of us? A Pattern of Debt The federal government's continuing deficit is well-known and widely-publicized. The problem has gotten worse by the year. Government has now become such a major user of borrowed funds that its actions are a principal determinant of interest and money market rates. Business, too, is the captive of growing indebtedness. The private sector requires continual infusions of borrowed capital. Today, however, financial expertise rather than entrepreneurial capacity has become the way to corporate success. Business fortunes rise and fall with the interest rate. When the rate becomes too high, as has happened the past several years, businesses strangle slowly. Incapable of surviving on their own resources, cut off from sources of affordable funds, businesses stagnate and firms collapse by the thousands. Competition among consumers, corporations, and government for a finite supply of funds has, by operation of the laws of supply and demand, driven the prime rate up and up. In 1950, our national baseline of economic health, loans from banks, equaled 33.7% of deposits, and the prime rate was a mere 2.07%. In 1980, when growing indebtedness was signaled by a loan to deposit ratio of 81.2%, the prime rate had soared to 15.27%. In fact, the prime rate has been higher longer in recent years than any time since the Civil War. Where the Debt Begins The American economy begins with raw materials. Without a continuous supply of raw materials, productive sectors cannot produce, consuming sectors cannot consume, and exchanges of goods and money cease. The economy grinds to a halt. The whole of the American economy depends on the primary suppliers, the industries that produce raw materials—namely agriculture, lumber, fishing, and mining. When these raw materials are receiving equitable prices at the point of first sale into the economy, the whole economy is healthy. But if they are receiving substandard prices, their debility handicaps us all. America's pattern of indebtedness originates in the primary-supply sector. Farming, which represents 70% of the primary-supply production, best demonstrates the causes and the consequences of debt. Borrowing This Year to Pay for Next Yet, despite this enviable record, agricultural earnings have fallen. Today's sophisticated farming industry earns less per acre in real dollars than its much-less-productive post-World War II counterpart. The culprit in agriculture's downturn is commodity prices. In 1950, commodity prices were strong. The ratio of prices farmers paid for factors of production to the prices they received for their crops — a figure called parity ratio — was about 100, as measured by the United States Department of Agriculture. By 1980, the parity ratio had fallen to 64. Agriculture has been squeezed tight by prices falling relative to expenses. Because agriculture earns less income than it needs to support itself, farmers must borrow. Between 1950 and 1980 the ratio of debt to equity in agriculture more than tripled. This swelling burden of debt decreased the number of farms, cut personal income to agricultural entrepreneurs, and shrunk the farm tax base. The Origin of Debt The economy begins with primary supply. All economic sectors depend ultimately on extracted raw materials. What is true of physical production is also true of the flow of money. The economy's many exchanges of money begin in the primary supply sector's use of the money it receives for raw materials to pay for such production factors as rent, capital investment, amortization, and so forth. The firms and individuals that receive this money use it to pay for their own factors of production. The recipients of this money also use it to pay for production factors. On and on the cycle goes. The money cycle is the basis of what economists call the “multiplier effect.” It is an accepted fact that every dollar received as gross raw material income in a given year enters five to seven subsequent exchanges—in a sense, $1 becomes $5 to $7. The multiplier effect is the key to understanding the central role of the primary-supply sector in the economy. Production begins in the primary-supply sector; so does the flow of money. If the primary-supply sector receives adequate income, then all the other sectors will receive adequate income. But if there is a shortfall in primary-supply sector income, then everyone down the line also comes up short. This is exactly what's been happening. Low commodity prices have cut agricultural income — and, in turn, the income of every other sector and industry. For each $1.00 agriculture loses, the economy's money cycle loses $5.00 to $7.00. The evidence is all around us, in long unemployment lines, shuttered factories, rising debt, and strangling interest rates. Something — the right thing — must be done. The Key The health of the primary-supply sector determines the health of the whole economy. Revitalizing primary supply means increasing net income. And that means equitable raw materials prices. The National Economic Stability Act The National Economic Stability Act (NESA), as proposed by the National Organization for Raw Materials in this publication, is a much-needed law. Simply, this proposed law establishes a basic price structure for the most primary of all primary-supply products, namely storable grains, potatoes, and meat and dairy animals. These commodities are the basic food and feed products. Once they are priced correctly, the prices of other agricultural products and other raw materials will fall into line, laying the foundation for prosperity and stability. The Main Provisions of NESA 1. NESA eliminates current federal crop subsidy, financing, and commodity buying programs. Since NESA will establish a new and truly fair market, continued government intervention will be unnecessary. Government may purchase food for such programs as foreign aid and school lunches, but it must buy all such commodities on the open market and pay the same price as other buyers. 2. Prices for storable foodstuffs and fiber (corn, wheat, barley, oats, soybeans, rice, cotton, potatoes, grain sorghum) and for livestock, dairy animals, and poultry will be set at a minimum of 90% of parity and a maximum of 115% of parity. These prices will be based on USDA figures drawn from the 1910-1914 base period, and they may fluctuate within the limits as the market demands. To ensure uniformity, the Consumer Price Index and the Wholesale Price Index will also be reset to fit the parity price structure. 3. The minimum wage equals the parity price of a bushel of corn. This feature ensures the adjustment of the whole economy to the new price structure for primary-supply products, and it guarantees mass purchasing power sufficient to absorb the supply of those products at the new market prices. 4. Agricultural producers may plant the crops they wish in the amount they wish, but they can sell only what the domestic and export markets will absorb. Production-for-sale quotas for each producer will be authorized by Marketing Certificates issued annually. 5. Excess product (i.e., over the amount allowed by the Marketing Certificate) must be stored at the producer's expense. The stored product will provide an important hedge against bad weather and crop failure. Also, it can provide the basis for establishing a National Food and Fiber Reserve, which would greatly strengthen the nation's defense. This provision distinguishes NESA from the current parity pricing law for milk, which encourages overproduction by obligating the government to buy excess production no matter how much it exceeds actual demand. 6. Imports of the products governed by NESA must be priced domestically at 110% parity. This provision is needed to prevent the domestic market from being flooded by cheap commodities from abroad. Ultimately, too, NESA will work to the benefit of raw materials producers overseas, by guaranteeing them a fair and adequate price for their products and thereby establishing their economics on the firm foundation needed for sound economic development. Making NESA Work Prices for regulated commodities will be set monthly for each Farm Credit District by the U.S. Department of Agriculture under the supervision of the National Board of Producers. The Board, chaired by the Secretary of Agriculture, will be elected by producers of the covered commodities. Each Farm Credit District will elect one member. Every county and state agriculture department will be advised by similar producer boards comprising three regular delegates and two alternates, all of whom must be producers of one or more basic commodities. It will be the responsibility of the National Board to establish domestic and foreign demand before the production season begins and to update these figures every quarter. The Board will also issue Marketing Certificates and update them quarterly. Certificates will be based on the production history of each grower in 1980-81, with allowances made for new and retiring producers as needed. If the National Board finds that demand falls below 1980-81 production levels, the shares of larger-than-average producers will be fractioned downward. To ensure compliance with NESA's regulations, sellers and buyers must report first-entry-to-market transactions to the county ASCS (now Farm Services Agency) office on a monthly basis. This requirement also covers co-ops, which are allowed to store, process, and market all members' produce covered by Marketing Certificates. Covered production may also be used as collateral for loans. Contractors who buy or sell at prices above or below the set levels will be fined three times the dollar amount of the transaction. Fraud, including selling without a Marketing Certificate, will be subject to other legal penalties. A commodity tax will be levied on each covered commodity upon first entry to the market. The amount of the tax will be computed to cover the cost of administering the program plus commodity marketing promotion and production research. The tax is to be included as an expense in the parity formula, so that domestic and foreign consumers and buyers will be contributing to the programs. In keeping with NESA's self-sufficiency, all CCC (Commodity Credit Corporation) loans will be transferred to private banks and financial institutions, and all federal programs governing the commodities regulated by NESA will be suspended. Likewise, special concessions granted to corporations engaged in productive agriculture will be suspended. In short, agricultural subsidies for the affected commodities will end. America’s New Economic Promise America is beset by a painful variety of troubling economic ills: • Federal deficit

Balancing the Federal Budget First, the bill significantly cuts current agricultural appropriations by reducing the administrative role of USDA and by replacing the crop-support loan program with market forces. In the 1982 budget alone, these changes would cut about $35-billion. Second, the tax base will expand and tax revenues will increase. This effect will be seen first in the primary supply sector. But as the increased income to that sector moves through the rest of the economy, gross income will increase in other sectors as well, thereby increasing the tax base. The same effect will occur in personal income as well as corporate income, when increased demand pushes wages up and widens employment opportunities. A Return to Stable Interest Rates NESA and restored price-cost equity will put an end to the debt spiral. Balancing of the Federal budget will take government out of the money market and lessen competition for funds, as will increased gross income to all economic sectors. Increased gross income will also allow firms to retire existing debt more quickly, thereby increasing loanable reserves and adding to the supply of money even as demand for that money falls. Interest rates must also decline. Inflation The Promise of Full Employment Re-Industrialization NESA: A Real Beginning NESA is not a welfare program. It is, in fact, just the opposite. It creates a structure that will free producers to do what they do best—produce. Government is not charged with running the economic game—as it has so often tried, and failed—but with merely ensuring that the rules of that game are observed. Nor is NESA a narrow law designed to guarantee the prosperity of only one group. NESA will help the whole economy, from the firms that produce primary-supply products to their ultimate consumers. With a fair price structure ensuring both an abundant supply of raw materials and the personal and corporate income needed to purchase them, the economy will provide growth and prosperity for all. In Memory "Blessed are they who hunger and thirst after justice for they shall have their fill." Ours is a world blessed with the potential for peace and abundance for all. But lust for power and greed for wealth on the part of a few have driven mankind to new lows of economic injustice and human suffering. The underpricing of raw material wealth has unleashed the tyranny of massive debt worldwide with the result that entire nations are bankrupt. Hunger and starvation are rampant throughout many parts of the world while America's granaries overflow and our farmers are driven from the land. Even in the so-called "wealthy nations," unemployment and bankruptcy are commonplace. At the local level, crime is on the increase as desperate people face a hopeless future. International frustrations have spawned wars in almost every corner of the globe until the specter of worldwide holocaust threatens the very future of mankind. It is the responsibility of us all to study and to understand this phenomenon and to bring that understanding to others so that justice and peace may prevail. Some who did understand were William Struckmeyer, Carl Wilken and Arnold Paulson. We gratefully acknowledge their years of service in bringing that understanding to others as well as the many contributions these men made to this report. Back Cover Quotes: "I place economy among the first most important virtues

"There are three ways a nation can become wealthy.

"It is common sense to take a method and try it.

NATIONAL ORGANIZATION FOR RAW MATERIALS (NORM) Mr. Alvin Rehse (deceased)

EXECUTIVE DIRECTOR

Mr. Vince Rossiter (deceased)

(Webmaster Note: The document above was published as an educational brochure by the National Organization for Raw Materials in the 1980s)

|

|||

| BACK TO TOP

OF PAGE! |

"Go a layer deeper into the mist and you will find that all production gets consumed, either by humans or animals, so where is the surplus? The answer is obvious. We never have a surplus. The surplus is only the mist we see that clouds the reality of world population growth. "The final constant here, is that all storable commodities always get consumed, the variable is always who, (or what creature) consumes, and where consumption takes place. Everything else said about ag economics, farm size, the future of family farming, farm prices, and so-called farm surpluses, fit into the above facts. "I seldom write or talk about this, because these real facts, if correctly charted, will leave most agriculture producers in a hopeless situation, as they are pushed closer and closer to the buffalo jump every year by our democracy's fatal flaw." Fred Lundgren

|

|||

|

Website optimized by: NORM Economics Org. Used with permission. Contact the webmaster Randy Cook Update 12/18/25 |